The final months of 2024 appear to be setting up a unique opportunity for credit union deposit growth in 2025. The average year-over-year growth rate for credit union deposits over the last 5 years has been just shy of 10%—but the competition has been fierce. Large national banks, regional banks, online-only banks, and fintechs are vying for depositors with digital-first experiences, convenience, and higher interest rates.

As inflation eases and a new period of declining interest rates lessens the high-yield savings competition, the landscape for attracting deposits is shifting. In a market where rates alone won’t be enough to stand out, the responsibility will be on credit unions to differentiate themselves.

Credit unions must focus on attracting and retaining high-quality deposits that deliver sustainable results by appealing to very specific member segments. Cementing their loyalty will require a highly tailored approach in the face of competitors who often lack this personalization. For credit unions to claim a strategic advantage, they must understand who to target and how.

Identifying High-Value Segments

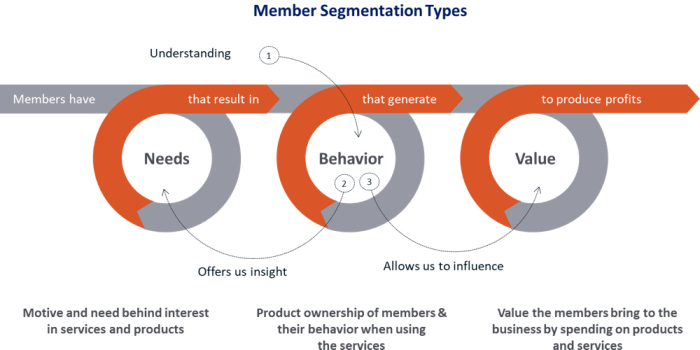

Rather than casting a wide net, credit unions can optimize deposit growth by Hypertargeting members who are most likely to contribute stable, long-term deposits. Focusing on the right segments will be a critical element of successful deposit strategies in 2025, and this means more deeply understanding the needs, behaviors, and values of each segment and building a differentiated marketing strategy for each.

Fast forward to today. Amazon uses sophisticated algorithms to analyze its massive datasets. These include individual customer purchase histories, search queries, and browsing behaviors. This analysis drives highly tailored shopping experiences for each user. When a customer searches for a product, for example, Amazon not only displays relevant items but also suggests complementary products based on what similar customers have viewed or purchased. Customer personalization has been a key contributor to Amazon’s increasing online sales.

The results make a clear case for investing in hypertargeting strategies. Among them:

- A 20-30% decrease in acquisitions costs for new members

- Marketing ROI that is two times higher

- Greater member engagement

- Improved ability to successfully offer right-fit products

Here are select examples of deposit segments for credit unions to prioritize in 2025.

Young Professionals

Younger demographics have long been a target of credit unions with aging memberships. Key characteristics of the young professional segment include:

- Career-focused

- Increasing disposable income

- Wealth-building

Their tech-savviness and preference for digital-first banking make them an ideal target for credit unions that offer seamless, tech-enabled banking experiences. Credit unions can target and appeal to this segment through digital channels offering the utmost in convenience and efficiency, such as automatic savings tools and user-friendly mobile banking. Additionally, credit unions should consider partner benefits with top-of-mind brands that appeal to this demographic.

Asset Protectors

These individuals may not have substantial liquid assets, but often own valuable resources such as homes, land, or sometimes, agricultural property, making them an important segment for credit unions to consider. Key characteristics of asset protectors include:

- A desire to protect and grow their assets safely.

- Cautious, yet strategic financial behavior.

- Valuing security and stability.

Credit unions can attract this segment by offering deposit products that cater to their desire for low-risk growth, keeping their assets protected, yet accessible when needed. Outreach to this segment should blend in branch consultations, direct mail, and email. Additionally, they are motivated by additional benefits for their dependents, and appreciate thoughtful touches such as recognition of their membership anniversary.

Affluent Homeowners

This segment is an important audience for credit unions because of their high net worth and significant cash reserves. Additional key characteristics of affluent homeowners include:

- Financial sophistication

- A desire to optimize savings and investments

- Seeking opportunities to make their deposits work for them

Affluent homeowners are drawn to financial products that offer a blend of high returns and low risk. Credit unions can capture this segment’s attention with premium service that includes calls from relationship managers, personalized direct mail and digital communication, and targeted high-value deposit offers.

Targeting Strategies to Reach Key Member Segments

While outreach to each target segment should be highly tailored to their specific needs and preferences, there are underlying principles that create a strong foundation for each campaign. The most effective marketing programs strike the right balance of highly personalized approaches and the unique value proposition that sets the credit union apart. An approach to compelling campaigns that resonate with the target audiences and drive meaningful engagement should incorporate:

Member-Centric Personalization: When data sources are aggregated and integrated, they help credit unions understand their members as whole persons, and not various data points. This comprehensive view is an important foundation for a truly member-centric approach—but still, a vast majority of credit unions lack the data maturity to glean more valuable insights.

Advances in AI and machine learning are rapidly bearing new tools that can move credit unions further along the data maturity curve. Among these capabilities is enriching internal data with additional sources such as social media, mobile usage, and geolocation information. Empowered to use data more effectively, credit unions can hyper-personalize creative messages so every interaction can become more relevant and impactful.

Smart Incentives: Incentives and special offers are proven strategies for driving new and existing members to engage with deposit products. A tangible reward coupled with the sense of urgency, and even exclusivity, is a powerful motivator for action. It’s a highly effective strategy for engaging and rewarding target segments, yet as many credit unions know, incentives can attract the wrong kind of member, too. To maximize the potential of incentives and minimize the downside, credit unions can smartly deploy ML-based models to exclude the populations most likely to take the incentive and leave soon after.

Community-Centric Messaging: Credit unions know well that demonstrating a genuine commitment to the communities they serve is a core driver of trust and loyalty among members. Today, credit unions can expand on this strategy with the power of Data and AI to create highly customized community-centric communications. The power of AI can deepen connections with content that is relevant and valuable to local community members, particularly when it highlights the community impact that is driven by the credit union.

Growing Quality Deposits With Precision

As the financial landscape evolves in 2025, credit unions have a significant opportunity to grow quality deposits by targeting the right member segments with precision. A personalized approach not only increases the likelihood of attracting quality deposits, but deepens member engagement and loyalty, affirming credit unions’ position as indispensable financial partners. As deposit behaviors change in 2025, credit unions that enable data-driven decision-making to laser-target their efforts will uncover a significant competitive advantage.

Learn More

Read more about AI and Credit Unions in the following Prowess Consulting articles and resources:

- Prowess Consulting Credit Union Industry Expertise

- Navigating AI for Business with Expert Guidance from Prowess

- AI Vs. Machine Learning Vs. Deep Learning

- Built-In Intel AI Accelerators and Why You Should Use Them

Prowess advises clients on a variety of AI ambitions and projects. Contact us to explore how we can help your credit union benefit from AI.

Pradeep Sharma

Pradeep Sharma is the Managing Director leading the Data and AI practice at Prowess Consulting. With over 10 years of experience in Data and AI, Pradeep is an expert in AI enablement, advanced analytics, process automation, and data management. His expertise spans industries, including credit unions, banking, and healthcare.

Related Posts

From Programmatic to Agentic: Scaling Compliance Management Operations with AI

Agentic AI makes enterprise compliance easier to achieve, document, and manage, empowering every employee with intelligent, scalable support.

Compliance Is Content: How Prowess Consulting Brings Value to Enterprise Regulatory Change Management

Our content-production experience uncovered inefficiencies in compliance management that our content experts were well-equipped to address.

Introducing Prowess LEAP™: AI-Enabled Insights for Modern Marketers

What if, instead of just producing more content, you could improve targeting with data-driven insights for smarter content strategies?